What You Want To Know If You're Pursuing Your Dream of Homeownership

What You Want To Know If You’re Pursuing Your Dream of Homeownership If you’re a young adult, you may be thinking about your goals and priorities for the months and years ahead. And if homeownership ranks high on your goal sheet, you’re in good company. Many of your peers are also pursuing their dream of owning a home. The 2022 Millennial & Gen Z Borrower Sentiment Report from Maxwell says: “Many young adults have demonstrated their resolve to embark on the journey toward homeownership soon. More than half of millennials and Gen Zs plan to apply for a mortgage sometime within the next year.” Let’s take a look at why homeownership makes the top of so many young buyers’ to-do list and what you need to consider to achieve your goals if you’re one of them. Top Motivators To Buy a Home Before you start the homebuying process, it’s helpful to know why homeownership is so important to you. The survey mentioned above sheds light on some of the top reasons why younger generations are looking to buy a home. It finds: 95% believe the cost of renting is too high 35% think owing a home is an important wealth building tool 16% seek the sense of security owning a home provides 37% plan to use it as an investment property No matter which of these resonates the most with you, know there are many financial and non-financial reasons why you may want to buy a home. While your top motivator may be different than that of your friends, they’re all equally valid and worthwhile. Key Obstacles and How To Overcome Them Whether your homeownership goals come from the heart or are driven by financial aspirations (or both), it can still be hard to know where to start when you’re looking to buy a home. From understanding the homebuying process, to getting pre-approved, and exploring down payment options, it’s a lot to wrap your head around. The same Maxwell survey also reveals key challenges for potential buyers. Thankfully, the knowledge and guidance of a trusted real estate professional can help you overcome both. Here’s a look at two of the hurdles potential homebuyers say they face: 1. The Mortgage Process Can Be Intimidating In the Maxwell study, 33.37% said one of their obstacles was that the mortgage process is confusing or difficult to understand. An article by OwnUp helps explain why the mortgage process is so challenging for buyers: “There is a general lack of knowledge about home financing. Mortgages are a complicated topic with no one-size-fits-all answer. It’s difficult to understand the space, let alone determine what the right course of action is based on your unique financial picture.” While you may be tempted to do a quick search online to find instant answers to your questions, it may not get you the information you need to understand the full picture. Especially when it comes to financial advice, you want to lean on a true expert. Having trusted professionals on your side can help you to learn what it takes to achieve your dream of homeownership. Not to mention, an expert can give you advice specific to your situation, not generic advice like you’ll find online. 2. It’s Hard To Know How Much You Need To Save In the Maxwell study, 45.75% believe they don’t have enough saved to cover their down payment or closing cost expenses. What you may not realize is that, today, there’s a growing number of down payment assistance programs available nationwide to help relieve this pressure. A report from Down Payment Resource says: “Our Q3 2022 HPI report revealed a 1.6% uptick in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,309, a net increase of 36 over the previous quarter.” Additionally, as the housing market cools, buyers are regaining some negotiation power and more sellers are willing to work with buyers to help with closing costs. Understanding what’s out there and the options available may help you achieve your dream of homeownership faster than you thought possible. Bottom Line If you’re serious about becoming a homeowner, know it may be more in reach than you think. Lean on trusted professionals like Jennifer Schurter, a Realtor in the Portland, Oregon area, to help you overcome challenges and prioritize your next steps.

Read More

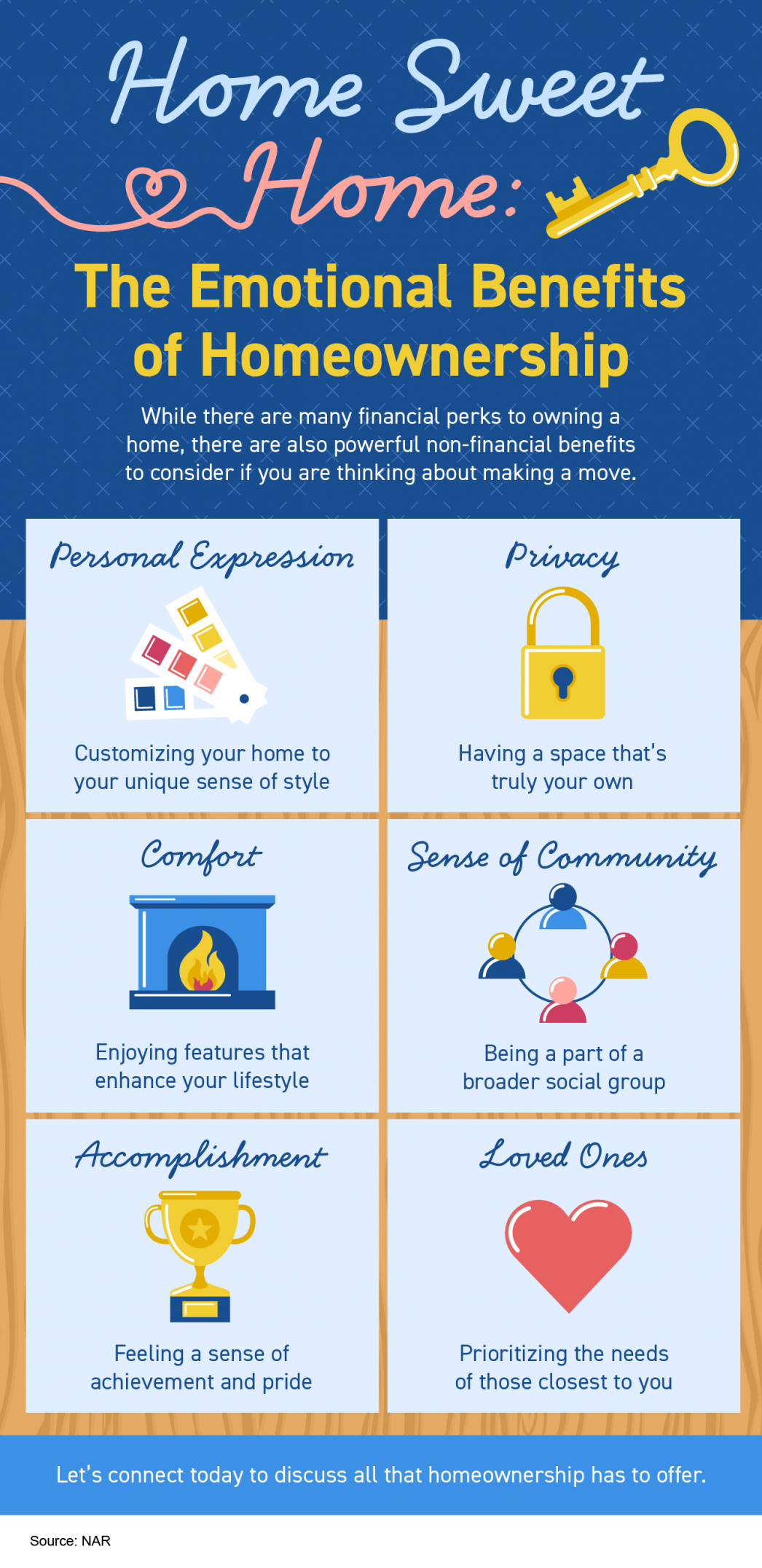

Home Sweet Home: The Emotional Benefits of Homeownership (INFOGRAPHIC)

Home Sweet Home: The Emotional Benefits of Homeownership Some Highlights While there are many financial perks to owning a home, there are also powerful non-financial benefits to consider if you’re thinking about making a move. Homeownership allows you to express yourself, gives you greater privacy and comfort, enhances your connection to your community and loved ones, and is an achievement to feel proud of. Connect with Jennifer Schurter, a Realtor in the Portland, Oregon metro area, today to discuss all that homeownership has to offer.

Read More

More People Are Finding the Benefits of Multigenerational Households Today

More People Are Finding the Benefits of Multigenerational Households Today If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational living has increased over the past 50 years. As you consider this option for your own home search, know it could help you on your homeownership journey and provide you with other incredible benefits along the way. Living with Loved Ones Could Help You Achieve Your Homeownership Goals There are several reasons people choose to live in a multigenerational household, and for many, the arrangement is a personal one. But according to the Pew Research Center, the top reason people choose to live together today is financial. A recent study from Freddie Mac also finds more people are choosing to buy a home together so they can save money in the homebuying process. As the study says: “. . . an increasing percentage of young adult first-time homebuyers are relying on support from older generations, including their parents, to buy a home together.” For these individuals, combining their resources can help them achieve their dream of buying and owning a home. By pooling their incomes together to make that purchase, they may be able to afford a home they couldn’t on their own. Other Key Benefits of Multigenerational Living Not to mention, living in a home with loved ones can have other benefits too, like giving you more quality time to spend together. Darla Mercado, Certified Financial Planner and Markets Editor for CNBC.com, explainshow this living arrangement can help on a personal and financial level: “Residing with relatives can offer advantages . . . you can pool multiple streams of income, for instance. And in households with young children, grandparents can pitch in with child care.” If this sounds like a great option for you, it’s important to work with a trusted real estate professional to discuss your needs. They can help you navigate the process to find the right home for you and your loved ones. Bottom Line More people are discovering the benefits of multigenerational living. For the best information and help deciding what’s right for your personal situation, connect with Jennifer Schurter, a Realtor in the Portland, Oregon metro area, and start the conversation today.

Read More

Categories

Recent Posts