Selling Your Home Soon? Here's the Skinny on Paint!

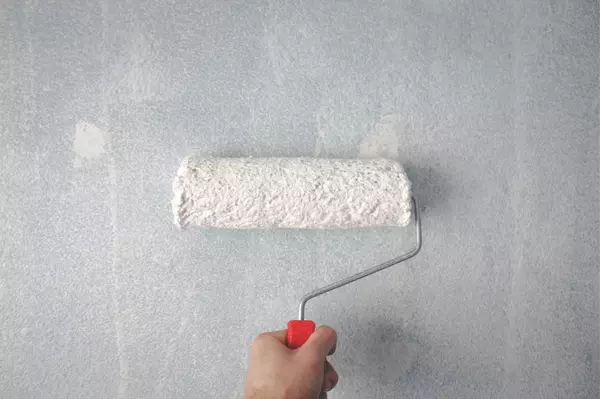

Selling Your Home Soon? Here's the Skinny on Paint! A question I receive often from people looking to sell is what do they need to do with their home to get it ready for market. Let's look at one simple project that actually has a great return on investment: PAINT! If selling your home is on the agenda, my suggestion is to lean into colors that offer a blank slate for buyers. Personal color choices (dark accent walls, bright colors, etc) could be a turnoff for buyers, even though we all know that paint is easy to change. The goal in mind here is to help your future buyer envision the space as their own. Your personality shouldn't overshadow the imagination of the buyer! What colors should you look for? Here are a few options that might give you an idea: Behr: Swiss Coffee Sherwin Williams: Agreeable Gray Benjamin Moore: Macadamia Nut Perhaps you just want a quick refresh for yourself and are open minded to different color choices (even trendy ones!). Check out the colors the major paint brands (like Behr, Sherwin Williams, and Benjamin Moore) are suggesting as "on trend" for the year. Maybe you'll see something in there that fits your personal style and space to a tee!

Read More

We Bought a House in 2007

Exactly 16 years ago today my husband, Jason, and I were in contract on our first house. We were so excited! We were so YOUNG! But wow! We felt so grown up and like we made a huge step, at the tender age of 22 and 23 years. Little did we know that just about one year later, the crash of 2008 would happen, devastating not only the real estate market but the entire economy. Our little neighborhood was hit hard, and seemingly overnight we lost $100,000 in value. Our grown up decision suddenly brought lots of grown up things I don't know I was prepared for, like the countless sleepless nights, piecing things together financially, long work hours, and subsisting on what I call the "Dave Ramsey Diet" of beans and rice and rice and beans with a side of Top Ramen. In all honesty, we probably shouldn't have had a mortgage loan granted to us. We were SO house broke that we barely had room in our budget to even have a life. And on top of things, it was a peach of a loan: an 80/20 ARM with a hard/soft prepayment penalty (read: we were STUCK), backed by a private equity firm that went under in the crash. We had no recourse other than to pay our mortgage, or walk away. We stayed. We paid our mortgage. We slept...sort of. It took us almost 10 years to come out on the other side of that event. Finally, when we were able to sell and make enough to move, we did it. Now we're in a different house that fits our needs so much better. I look back at those years and think...jeeze...we made it through THAT. Our experience so early in our adult lives really painted my perspective of how I view my role as a Real Estate agent. Being an advisor with those circumstances in my rearview gives me perspective into what a homebuyer feels because I have been there. While those years were so hard, I don't regret that we bought that house. “The comfortable road will never lead you to the person you are destined to be in your life, never.” -Ed Mylett Thanks for reading!-Jennifer Schurter

Read More

What Are Mortgage Rates Like Today (January 2023)

"What are mortgage rates like today?" I'm not a lender. However, I do work to keep folks updated about the entire home buying puzzle. Many people I speak to are planning a home purchase in the coming months, so naturally this question comes up. Right now (as in...RIGHT now) we're seeing some interesting trends. According to Mortgage News Daily (1/18/2023), rates are at 4-month lows. Granted, we may never see anything near the historically low rates experienced over the last two years. For those that may need to make a move, the timing might be right. It is my opinion that we are in a limited window where demand is softer than it was, giving buyers an opportunity to actually negotiate with sellers on price and/or pre-paid expenses like closing costs. In addition, many buyers may have the ability to capture lower rates than a couple months ago. If you're on the fence, now could be the time to capitalize on the opportunity. As soon as rates continue to come down and as we near the spring season, my prediction (sans crystal ball) is that we could see demand increase as other fence-sitters start their search again. Inventory is still low in our area, which could open the door for more competition in the buyer pool. Starting the process doesn't have to be overwhelming! If you're looking to buy a property in 2023, and not sure where to get started, let's talk! I'm Jennifer Schurter, a real estate agent in the Portland, Oregon metro area and I can help you connect with a lender to answer all your mortgage questions.

Read More

Categories

Recent Posts